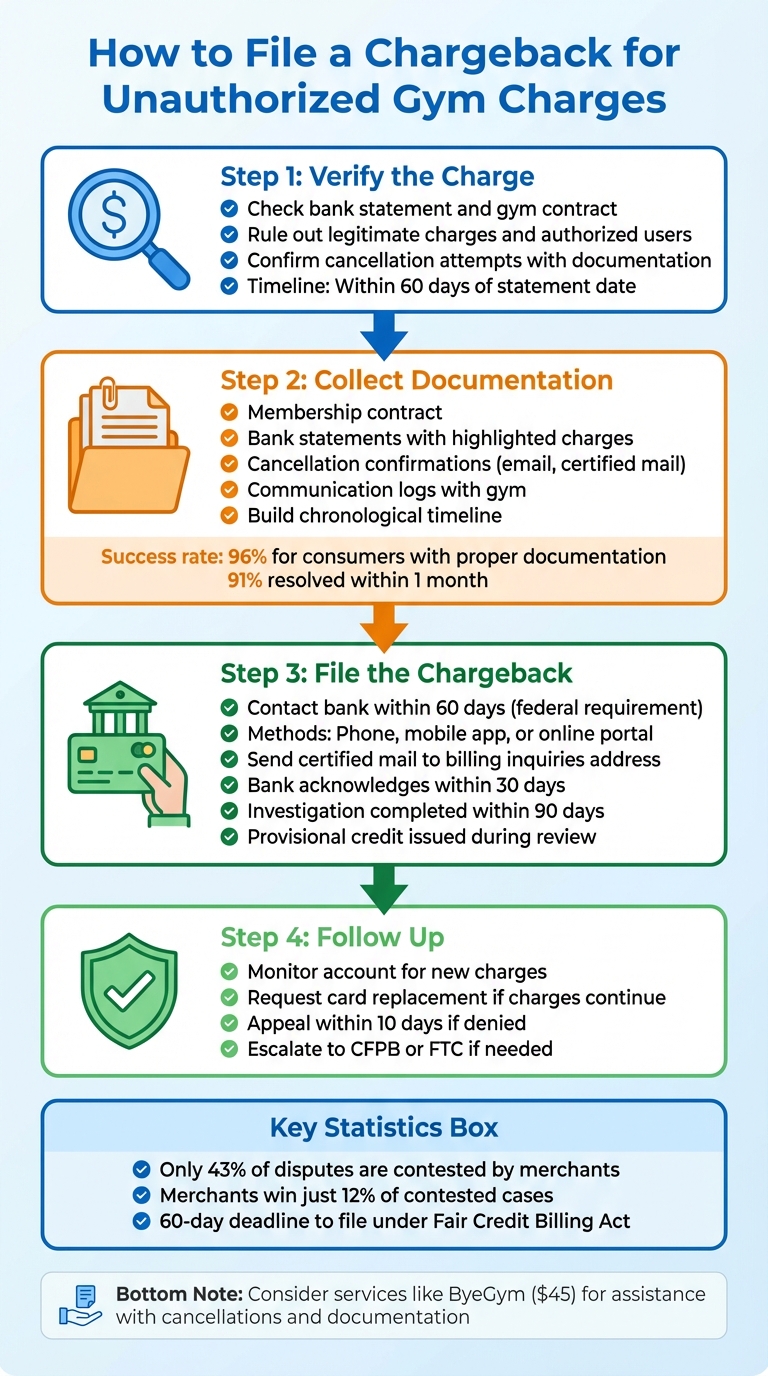

How to File a Chargeback for Unauthorized Gym Charges

Step-by-step guide to disputing unauthorized gym charges: verify the bill, gather evidence, file a chargeback within 60 days, and prevent future billing.

To file a chargeback for unauthorized gym charges, contact your bank or credit card company within 60 days of the charge, provide your cancellation proof (certified mail receipt, delivery confirmation), and request a dispute for "services not rendered" or "unauthorized transaction." Most banks resolve gym chargebacks in the customer's favor when cancellation documentation exists.

If you've been charged by a gym after canceling your membership or notice a charge you didn’t approve, you can dispute it through a chargeback. A chargeback is a process where your bank reverses a transaction if you can prove it was unauthorized or incorrect. Here's how to handle it:

- Verify the Charge: Check your bank statement and gym contract to confirm the charge wasn’t legitimate (e.g., a forgotten subscription or authorized user).

- Gather Evidence: Collect proof like cancellation confirmations, email correspondence, and your membership agreement.

- File the Chargeback: Contact your bank within 60 days of the statement showing the charge. Submit a formal dispute online, via app, or certified mail, including all evidence.

- Follow Up: Monitor your account for updates and ensure no further charges occur. If denied, appeal or escalate to regulatory agencies.

Act quickly, as banks have specific timelines for disputes. If managing this feels overwhelming, services like ByeGym can assist with cancellations and documentation for $45.

4-Step Process to File a Gym Membership Chargeback

How to WIN a Chargeback Dispute (timeline, tips, and how-tos)

Step 1: Verify the Charge is Unauthorized

Before filing a chargeback, make sure the charge in question is actually unauthorized. Disputing a legitimate transaction - even one you may have forgotten about - can qualify as "friendly fraud." This could lead to serious repercussions, like being blacklisted by the merchant or even having your account sent to collections.

Check Your Bank Statement and Gym Contract

Start by reviewing your bank or credit card statement. Pay close attention to the merchant name, transaction date, and exact amount charged [2][8]. Gym-related charges might not show up under the gym's brand name; instead, they could be listed under a parent company or a third-party billing processor. If the name looks unfamiliar, a quick online search might clarify things.

Next, go through your gym contract. Look for details about billing frequency, fees, or any authorized add-ons. Keep in mind that federal law requires gyms using automatic debits to notify you at least 10 days in advance if a payment differs from the agreed-upon amount [3]. Be on the lookout for errors like duplicate charges, calculation mistakes, or fees for services you didn’t receive.

Once you've identified any discrepancies, focus on ruling out legitimate charges.

Eliminate Legitimate Charges

What seems like an unauthorized charge might actually be valid. Check whether an authorized user incurred the charge or if a trial membership automatically converted into a paid subscription. Also, review your contract for any additional services - like personal training, guest passes, or locker rentals - that you might have approved but forgotten about.

According to HelpWithMyBank.gov, unauthorized use is defined as:

"Unauthorized use is when someone other than the cardholder or a person that has the actual, implied or apparent authority uses a credit card and the cardholder receives no benefit from the use" [6].

If you or someone you permitted used the service, the charge is considered authorized - even if you now regret the decision.

Before moving forward, double-check your cancellation details.

Verify Your Cancellation Attempts

If you’ve canceled your membership, gather any proof of cancellation right away. This could include a confirmation email, a certified mail receipt, a completed cancellation form, or even a text message from the gym. Compare the date of your cancellation request with the date of the disputed charge. If the charge occurred after your confirmed cancellation date, it’s likely unauthorized.

Christopher Elliott, Founder of Elliott Advocacy, highlights the importance of written documentation:

"If you can get something in writing that promises a refund, your chargeback will usually be a slam-dunk" [1].

Always cancel in writing to create a solid paper trail. Keep in mind, you need to dispute any questionable charges within 60 days of the first statement showing the error [2].

Step 2: Collect Documentation for Your Chargeback

After confirming the charge is unauthorized, the next step is to prepare your dispute. The stronger your documentation, the better your chances of success. Did you know that credit card disputes boast a 96% success rate for consumers? Plus, 91% of cardholders who dispute charges see resolutions within a month [7].

Josh Phelps from Zen Payments highlights why acting quickly is crucial:

"The more compelling evidence you have to support your claim, the better your chances of winning. Start gathering documentation the instant you suspect an issue." [10]

Your goal is to counter the gym's claims with clear, factual evidence. Start by collecting the necessary documents to back your case.

Gather the Right Documents

Begin with the basics: your membership contract, bank statements showing the disputed charges (highlighting the specific transactions), and any cancellation confirmations. Proof of cancellation is key - this could include email confirmations, screenshots, or certified mail receipts that show when you ended your membership. Be sure to also document any communications with the gym, noting critical details.

Even a single piece of evidence, like a credit memo or a text from a gym manager promising a refund, can significantly strengthen your case. Additionally, take screenshots of the cancellation and refund policies that were in place when you signed up, as these policies might have changed since then.

When submitting your evidence to the bank, always send high-quality copies or digital scans - never the originals. Keep the originals safe for your records. Once you've gathered everything, organize it in chronological order to create a clear and cohesive story.

Build a Timeline of Events

A well-organized timeline ties your evidence together and makes your case easier to follow. Include key dates such as when you signed the membership contract, submitted your cancellation, and noticed the disputed charges on your statement. For each charge, note the transaction date, amount, and the merchant's name. If you contacted the gym to request a refund before involving your bank, document those interactions and any responses you received. Banks often require proof that you tried to resolve the issue directly with the merchant.

Save your timeline in a shareable digital format, making it easy to upload to your bank's dispute portal. Stick to the facts - avoid emotional language to maintain professionalism with bank investigators. If you spot any gaps in your evidence, try to fill them before filing your dispute. A clear, factual, and well-documented case can make all the difference.

Step 3: File the Chargeback with Your Bank

Now that you’ve gathered all your evidence from Steps 1 and 2, it’s time to officially file your dispute. According to federal law, you need to submit your chargeback within 60 calendar days from the date your first statement with the unauthorized gym charge was sent to you [2]. If you miss this deadline, you may lose your legal protections under the Fair Credit Billing Act.

How to Start the Dispute

You can file your chargeback in one of three ways: call the number on the back of your card, use your bank’s mobile app, or log into your online banking portal [2]. Many banks have streamlined this process, offering dedicated sections in their apps or websites where you can upload documents and monitor the status of your dispute.

Once you’ve initiated the dispute, follow up with a written letter sent via certified mail to your bank’s billing inquiries address [2]. This address is typically different from the one used for monthly payments, so double-check your bank statement or their website. Make sure to send your letter via certified mail with a return receipt to confirm that your bank received it [2].

While your dispute is under review, you’re allowed to withhold payment for the disputed amount as well as any related finance charges [3].

Information Your Bank Will Request

When filing your dispute, be ready to provide specific details. Your bank will need your name, billing address, and card number [11]. You’ll also need the exact amount of the disputed charge, the transaction date, the gym’s name, and a detailed explanation of why the charge is unauthorized [11]. Common reasons for gym-related disputes include "unauthorized transaction", "canceled service", or "charged more than agreed" [11].

Include the date of the first statement showing the error, and attach all the evidence you collected in Step 2. This could include your cancellation confirmation, communication logs with the gym, and a copy of your membership contract [11].

In some cases, the bank may ask for a signed written statement or affidavit to validate your claim [12]. Keep copies of everything you submit and maintain a detailed log of all follow-up calls, noting dates and the names of the representatives you spoke with [11].

The Chargeback Process Timeline

After you file, your bank must acknowledge receipt of your dispute in writing within 30 days [3]. They are then required to complete their investigation within two full billing cycles, but no later than 90 days from the date of your initial report [3]. During this time, most banks will provide a "provisional" or temporary credit to your account for the disputed amount [1]. This credit gives you immediate relief but can be reversed if the bank ultimately sides with the gym [1].

| Step | Action | Timeline |

|---|---|---|

| Notification | Report the unauthorized charge to your bank | Immediately |

| Written Notice | Send a formal dispute letter via certified mail | Within 60 days of statement date |

| Acknowledgment | Bank confirms receipt of your dispute | Within 30 days |

| Investigation | Bank reviews your evidence and the gym’s response | Up to 90 days |

| Resolution | Bank informs you of their final decision | Within 90 days |

The bank will forward your dispute to the gym, giving them the opportunity to either accept the chargeback or contest it. If the gym contests, they may provide evidence such as signed contracts, emails, or their cancellation policy [1]. Interestingly, only about 43% of disputes are contested by businesses, and they win just 12% of those cases [1]. While your dispute is active, the bank is prohibited from reporting the amount as delinquent to credit bureaus or pursuing legal action to collect it [3].

Step 4: Follow Up and Prevent Future Charges

Keep an Eye on Your Account

Stay on top of your account activity by reviewing your statements as soon as they’re posted. Use electronic notifications or account alerts through your banking app to catch unauthorized charges quickly [3]. Keep in mind, gyms often process payments under a parent company or a different business name, which can make charges harder to recognize [13]. If your bank issues provisional credit during a dispute, monitor it closely - this credit can be reversed if the gym wins the dispute [9]. If you notice unauthorized charges continuing, it’s time to take further action.

Steps to Take if Charges Don’t Stop

If the gym keeps billing you after a chargeback, dispute every new transaction immediately. To block further unauthorized charges, request a replacement card or use your banking app’s card lock feature [4][13][14].

If your dispute is denied, don’t give up - submit a written appeal within 10 days of receiving the bank’s decision [3]. Ask for copies of the documentation they used to make their decision and send your appeal via certified mail with a return receipt for proof [9]. If the issue isn’t resolved internally, escalate the situation by filing a formal complaint with the Consumer Financial Protection Bureau (CFPB) or the Federal Trade Commission (FTC) [2]. Keep a thorough record of all interactions with your bank and the gym, including dates, the names of representatives, and copies of emails or letters. These details can strengthen your case if you need to dispute further charges [5].

How ByeGym Can Assist You

If dealing with gym membership cancellations feels overwhelming, ByeGym offers a hassle-free solution. They handle the entire USPS Certified Mail process and provide all the necessary documentation to support your chargeback claim. This includes drafting a professional cancellation letter that complies with state laws, along with tracking information and delivery confirmation.

Should your gym continue to bill you after cancellation, ByeGym equips you with a chargeback kit that includes the certified mail receipt, your cancellation letter, and proof of delivery. For a flat fee of $45, ByeGym offers this service with a full refund guarantee if they can’t successfully cancel your membership. This comprehensive approach not only simplifies the process but also strengthens your chargeback claim, giving you peace of mind.

Conclusion

Dealing with unauthorized gym charges can be straightforward if you follow a few key steps. First, confirm that the charge is indeed unauthorized by carefully reviewing your bank statements and gym contract. Then, gather all relevant documentation - such as cancellation emails, your original contract, and any written agreements from the gym. These records are essential for building your case. Interestingly, merchants only contest about 43% of disputes and win just 12% of those they challenge[1]. With solid evidence in hand, you’ll be ready to dispute the charge effectively.

Make sure to file your chargeback within 60 days to stay protected under the Fair Credit Billing Act[2][1]. Send your dispute letter via certified mail with a return receipt to ensure proof of delivery, and follow up regularly to track the status of your claim. If the charges persist or your initial dispute is denied, act quickly - dispute new charges and appeal within 10 days[3].

For a hassle-free option, you might consider using ByeGym, a service that handles the entire process for a $45 fee. They take care of certified mail cancellations, provide all the necessary documentation for chargeback claims, and even offer a full refund guarantee if they’re unable to cancel your membership. This service can save you time and effort while helping to prevent future unauthorized charges.

FAQs

What can I do if my chargeback for unauthorized gym charges is denied?

If your chargeback request gets denied, the first step is to reach out to your bank or credit card issuer and ask for the specific reason behind their decision. They’ll usually provide a written explanation, often referred to as a reason code, which details what was missing or insufficient in your claim. Take the time to review this feedback thoroughly. Then, gather any additional evidence that directly addresses their concerns - this could include a copy of the gym’s cancellation policy, proof of an unauthorized charge, or even a signed statement confirming you didn’t authorize the membership. Once you’ve compiled this new information, you can file an appeal or a second-level dispute, making sure to reference your original case and include the updated evidence. Most banks set a deadline for appeals, often within 30 days of the denial, so act quickly.

If your appeal is denied as well, don’t give up just yet. You can escalate the issue by filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general. These organizations may investigate or push the issuer to revisit their decision. For disputes involving larger amounts or if the issue remains unresolved, you might consider taking legal action, such as filing a case in small claims court. Throughout this process, keep detailed records of all communications and evidence - these can be crucial in building a strong case.

How can I avoid unauthorized gym charges in the future?

To avoid unauthorized gym charges, start by regularly reviewing your bank or credit card statements. Setting up transaction alerts can help you catch unexpected charges right away, allowing you to report them to your bank quickly. Consider using a virtual card or a separate card solely for gym payments - these can be canceled without disrupting your primary account. Some banks also let you set spending limits or block specific merchants, adding another layer of protection.

Make sure to contact the gym directly to confirm that all automatic payment authorizations have been canceled. Request written confirmation of the cancellation and, if possible, ask them to remove your payment information from their system. Keep a record of all communications, including emails or letters about your cancellation, for future reference. By staying vigilant, using secure payment methods, and maintaining clear communication with the gym, you can greatly reduce the chances of dealing with unauthorized charges.

What kind of proof do I need to file a chargeback for unauthorized gym charges?

To make your chargeback request stronger, collect specific and well-organized evidence. This could include:

- A copy of your bank or credit card statement highlighting the disputed charge.

- Documents like cancellation confirmations, original contracts, or receipts.

- Records of communication with the gym, such as emails, letters, or chat transcripts.

Having thorough and clearly presented documentation will help your bank or credit card company assess your case more efficiently, boosting the likelihood of a favorable outcome.